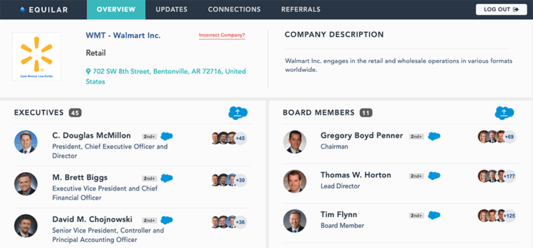

ExecAtlas Portal

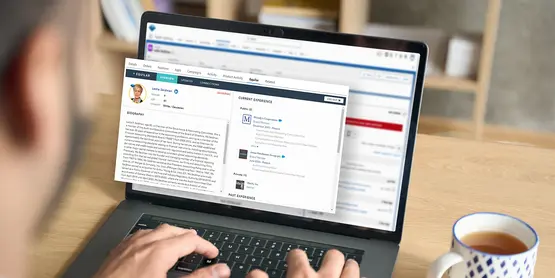

Access the ExecAtlas database on your desktop or through the app to gain real-time business and relationship intelligence updates.

Featured Product

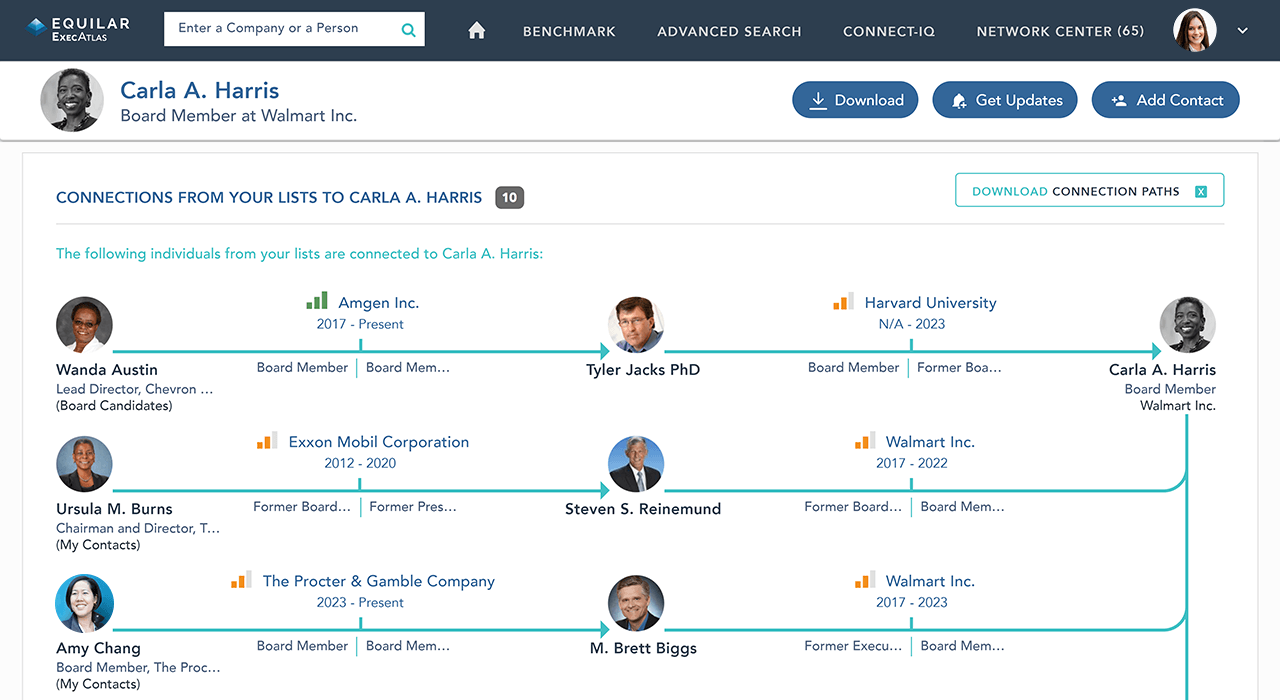

ExecAtlas is a cloud-based relationship intelligence platform crafted for dealmakers, business development pros, and sales teams. Conquer the "last mile" challenge by arming your team with real-time relationship insights to close more deals.

Access the ExecAtlas database on your desktop or through the app to gain real-time business and relationship intelligence updates.

Embrace the future with superior CRM data for AI, Machine Learning, and next-gen applications. Enrich your CRM with unmatched relationship intelligence.

Nasdaq, a global technology company serving the capital markets, has selected the Equilar ExecAtlas platform to enhance its relationship intelligence capabilities and optimize its tech stack operations. The strategic move aims to streamline access to client relationship insights and workflows.